Why Texas Workers’ Compensation Matters for Injured Employees

Texas workers compensation is a state-regulated insurance program that provides medical care and income benefits to employees injured on the job. Unlike in many states, Texas doesn’t require most private employers to carry this coverage, making it crucial for workers in Austin, Cedar Park, Round Rock, and surrounding areas to understand their rights.

Key Facts About Texas Workers’ Compensation:

- No-fault system – Benefits are available regardless of who caused the accident.

- Four types of benefits – Medical, income, death, and burial coverage.

- Not required for most employers – Texas is a “non-subscriber” state.

- 30-day reporting deadline – You must notify your employer within 30 days of your injury.

- One-year filing deadline – You must submit claim form (DWC Form-041) within one year.

- Regulated by TDI – The Texas Department of Insurance oversees the system.

The system operates differently than in other states because employers can choose whether to participate. This unique structure affects your options if you’re hurt at work. When an Austin-area worker suffers a job-related injury, workers’ compensation can cover everything from emergency room visits to physical therapy, plus replace a portion of lost wages.

The Division of Workers’ Compensation (DWC) regulates the system, but insurance carriers handle payments. This guide will help you steer the process, understand your rights, and know when you might need legal help.

Learn more about Texas workers compensation:

The Foundation of Texas Workers’ Comp: Who’s Involved and What’s Covered?

Texas workers compensation is a state-regulated insurance program overseen by the Texas Department of Insurance (TDI) and its Division of Workers’ Compensation (DWC). The DWC administers the system, helps resolve disputes, and provides workplace safety services for employers in Austin and across the state, but it DWC does not pay benefits. Instead, benefits are paid by insurance companies like Texas Mutual, self-insured employers, or governmental entities. You can learn more about the About the Division of Workers’ Compensation (DWC) on the TDI website.

An employer’s decision to carry workers’ comp is critical. If they do, they gain legal protection from most employee lawsuits. If they don’t, they can be sued directly by an injured worker.

For an injury to be covered, it must be a “compensable injury” that occurred within the “course and scope of employment.” Coverage is typically excluded if injuries were self-inflicted, occurred during horseplay or while intoxicated, happened outside of work, were caused by an “act of God” (unless the job has high exposure), or resulted from a personal conflict unrelated to the job.

Who is Eligible for Benefits?

Eligibility for Texas workers compensation hinges on being an “employee” who sustains a “work-related injury or illness.” Independent contractors are generally not covered. To qualify, you must take two critical steps:

- Report your injury to your employer within 30 days from the date you were hurt or realized the condition was job-related.

- File a formal claim (DWC Form-041) with the DWC within one year of the injury date.

Missing these deadlines can jeopardize your right to benefits.

The Role of the Division of Workers’ Compensation (DWC)

The DWC is the state agency that regulates the Texas workers compensation system to ensure all parties—employees, employers, and insurance carriers—comply with state law. Their key responsibilities include:

- System Regulation: Administering the system and enforcing compliance with the Texas Workers’ Compensation Act.

- Dispute Resolution: Providing a framework, like benefit review conferences, to resolve disagreements about claims.

- Workplace Safety: Offering resources and training to promote safer workplaces across Texas, aiming to prevent injuries.

The DWC’s mission is to ensure the system is balanced and fair. Their customer service line (1-800-252-7031) is a valuable resource for questions about your claim.

Unpacking Your Benefits: Medical, Income, and More

If you’re injured on the job in Cedar Park or involved in a workplace accident in Round Rock, understanding the benefits available through Texas workers compensation is essential. These benefits are designed to help you recover physically and financially.

There are four primary types of benefits:

- Medical benefits: Cover costs for reasonable and necessary medical care.

- Income benefits: Replace a portion of wages lost due to your injury.

- Death benefits: Provide financial support to eligible family members of a deceased worker.

- Burial benefits: Cover a portion of the deceased employee’s funeral expenses.

What Types of Benefits Does Texas Workers’ Compensation Provide?

Medical Benefits: These cover all reasonable and necessary medical care for your work injury, including doctor visits, surgery, and physical therapy. If your employer has a certified health care network, you must choose a doctor from their list. The DWC offers resources for Finding a doctor.

Income Benefits: These replace a portion of lost wages if your injury keeps you from work for more than seven days. There are four main types:

- Temporary Income Benefits (TIBs): Paid while you recover, typically replacing about 2/3 of your average weekly wage. TIBs end when you reach Maximum Medical Improvement (MMI) or after 104 weeks.

- Impairment Income Benefits (IIBs): Paid after you reach MMI, based on a permanent impairment rating assigned by a doctor.

- Supplemental Income Benefits (SIBs): May be available after IIBs end if you have a high impairment rating and are still unable to earn most of your pre-injury wages.

- Lifetime Income Benefits (LIBs): Reserved for the most severe, catastrophic injuries like total paralysis or blindness.

You can find more details on Workers’ compensation income and medical benefits.

How Benefits Are Calculated and Paid

Income benefits are based on your Average Weekly Wage (AWW), calculated from your earnings (including overtime and certain benefits) in the 13 weeks before your injury. State maximums and minimums apply to these payments. You can Learn about average weekly wage on the DWC site.

Death and Burial Benefits: If a work injury is fatal, the system provides for the worker’s family. Burial benefits cover up to $10,000 in funeral expenses. Death benefits provide a portion of lost income to eligible dependents. More information is available on the Death and burial benefits page.

Benefits are typically paid by check or electronic funds transfer. It’s crucial to keep your contact and banking information updated with the insurance carrier to avoid delays.

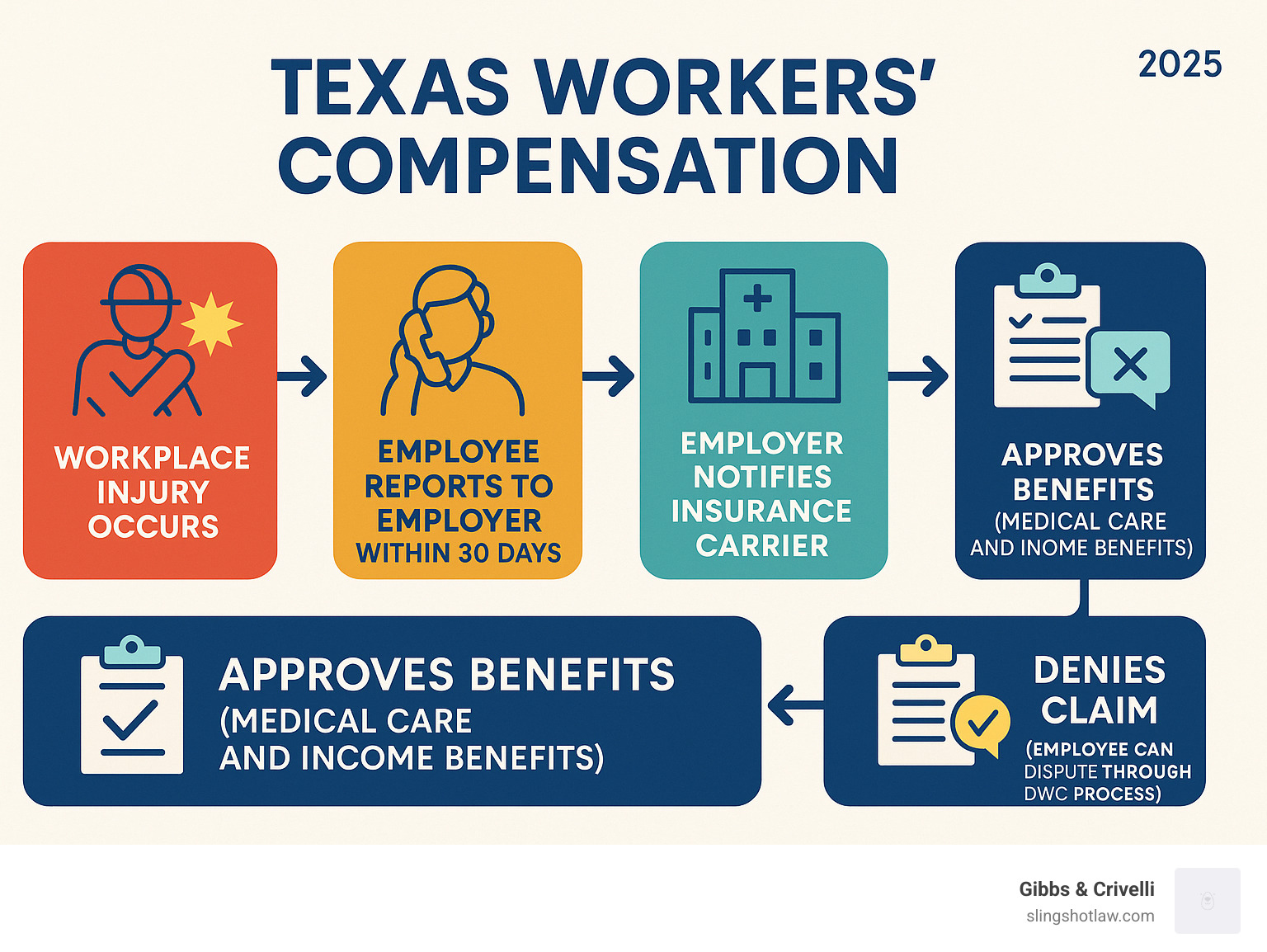

The Claims Process: A Step-by-Step Guide for Injured Texas Workers

Filing a Texas workers compensation claim in Austin or Cedar Park involves a few key steps. First, you must report the injury to your employer, explaining how, where, and when it happened. This must be done within 30 days. While verbal notice is acceptable, providing it in writing is highly recommended. Next, you must file the claim form, DWC Form-041, with the state. Your employer is then required to notify their insurer within eight days of learning about your injury, which starts the insurance claim process.

Critical Deadlines You Can’t Miss

Missing deadlines can mean losing your right to benefits. Remember these critical dates:

- 30-Day Injury Reporting Rule: You must tell your employer about your injury within 30 days.

- One-Year Filing Deadline: You must submit your Employee’s Claim for Compensation for a Work-Related Injury or Occupational Disease to the DWC within one year.

- Employer’s 8-Day Notification Deadline: Your employer has eight days to inform their insurance carrier.

If you’re struggling to meet these deadlines in Round Rock or Georgetown, A Texas Work Injury Attorney can help meet deadlines.

Your Rights and Responsibilities

As an injured worker, you have both rights and responsibilities. You have the right to medical care, the right to dispute a denial, and protection against employer retaliation. If you face retaliation, you can submit an employment discrimination complaint with the Texas Workforce Commission.

Your responsibilities include reporting all income you earn while receiving benefits and attending all required medical exams. For more details, the Office of Injured Employee Counsel explains Your rights and responsibilities as an injured employee. Our Workplace Injury Lawyer assistance can help protect your rights throughout Central Texas.

Navigating the Texas System: Employer Roles and Non-Subscribers

Unlike in most states, Texas workers compensation isn’t required for most private employers. This choice dramatically affects your options if you get hurt on the job in Austin, Cedar Park, or Round Rock.

When employers carry workers’ comp (making them “subscribers”), they gain significant legal protections. In return, they must provide a safe workplace, post notices about their coverage, report your injury to their insurer within eight days, and cooperate with the claims process. Their main benefit is protection from most lawsuits by injured employees; the workers’ comp system becomes your exclusive remedy.

| Feature | Subscriber Employer (Has WC) | Non-Subscriber Employer (No WC) |

|---|---|---|

| Legal Protection | Protected from most lawsuits by injured employees | Loses legal protection against most lawsuits from injured employees |

| Employee’s Recourse | Workers’ compensation benefits (no-fault) | Right to sue employer for negligence |

| Common Law Defenses | Retains defenses (e.g., assumption of risk, contributory negligence) | Loses key common law defenses |

| Benefit Payment | Insurance carrier pays benefits | Employer (or their liability insurer) pays damages if sued successfully |

| Mandatory Coverage | Voluntary for most private employers | Not required, but faces greater lawsuit exposure |

What if My Employer Doesn’t Have Texas Workers’ Compensation?

If your employer in Georgetown or Pflugerville is a “non-subscriber” (doesn’t have workers’ comp), they lose these legal protections. This means you retain your right to sue them directly for negligence. Crucially, non-subscribers also lose key common law defenses, meaning they can’t argue that you assumed the risk of a dangerous job or that your own negligence contributed to the accident.

While this makes it easier to win a lawsuit, you still must prove your employer was negligent. These lawsuits can be complex and lengthy, unlike the no-fault workers’ comp system. Our team has experience Exploring Workplace-Related Personal Injuries and Their Implications in these non-subscriber cases.

Can I Sue My Employer for a Work Injury in Austin?

The ability to sue your employer depends entirely on their insurance status.

- If your employer has workers’ comp (a subscriber): Generally, no. The system is your “exclusive remedy.” The only major exception is if a death is caused by the employer’s gross negligence.

- If your employer does not have workers’ comp (a non-subscriber): Yes, you can sue them for negligence. This is your primary path to recovery.

- Third-Party Liability: Regardless of your employer’s status, you may be able to sue a negligent third party, like the manufacturer of faulty equipment or another contractor on a Killeen construction site. These claims can be pursued alongside a workers’ comp claim.

Navigating these options requires a deep understanding of both workers’ comp and personal injury law. Our Austin On The Job Injury Lawyer team handles cases involving both subscriber and non-subscriber employers across Central Texas.

When Things Go Wrong: Disputes, Denials, and Finding Help

Even if you follow all the rules, you may face problems with your Texas workers compensation claim. Claim denials are common, with insurers arguing an injury isn’t work-related or that you missed a deadline. You might also face disputed benefits, where the carrier questions the necessity of your medical treatment or miscalculates your payments. Dealing with difficult insurance adjusters or facing illegal employer retaliation in Round Rock or Harker Heights can add to the stress. It’s against the law for an employer to treat you differently for filing a claim.

Getting Help with Your Claim

You don’t have to face these challenges alone. Texas provides several resources to help injured workers.

The Office of Injured Employee Counsel (OIEC) is a free state resource that advocates for injured employees and can be reached at 866-393-6432. You can get information by Contacting the OIEC for free assistance. Their Ombudsman services can help you steer the dispute process.

If informal talks fail, the DWC offers a Benefit Review Conference (BRC), a meeting to resolve issues with the insurance carrier. If the BRC doesn’t work, the case can proceed to a more formal hearing.

When your case is complex or your benefits are wrongfully denied in the Austin area, our Hurt at Work Attorneys can provide the legal representation you need to fight for your rights. Seeking help is the best way to protect your family’s financial security while you focus on getting better.

Conclusion

When you’re hurt on the job in Austin, Cedar Park, or Round Rock, navigating the Texas workers compensation system can be challenging, but understanding the fundamentals is key. Remember these critical points:

- Deadlines are absolute: You have 30 days to report your injury and one year to file your claim. Missing them can end your case.

- Employer status matters: Know if your employer is a subscriber (has coverage) or a non-subscriber. This determines whether you file a claim or can sue for negligence.

- You have rights: You are entitled to medical care and income benefits, and you can dispute denials. It is illegal for your employer to retaliate against you for filing a claim.

At Slingshot Law, we’ve helped injured workers across Central Texas, from Georgetown to Temple, fight back against insurance companies. We know how they operate and how to counter their tactics. You shouldn’t have to face them alone while you’re trying to heal.

Every workplace injury is unique. If your claim is complex, has been denied, or your employer is a non-subscriber, getting personalized legal guidance is crucial. If you’ve been injured on the job in Austin, our work injury lawyers can protect your rights. Contact us for a consultation and let us fight for the compensation you need to get your life back.