The Frustration of a Denied Claim in Texas

An insurance claim denial is devastating, especially when you’re already dealing with injuries, property damage, or the loss of a loved one. You paid your premiums faithfully, but when you need your insurance most, they’ve said no.

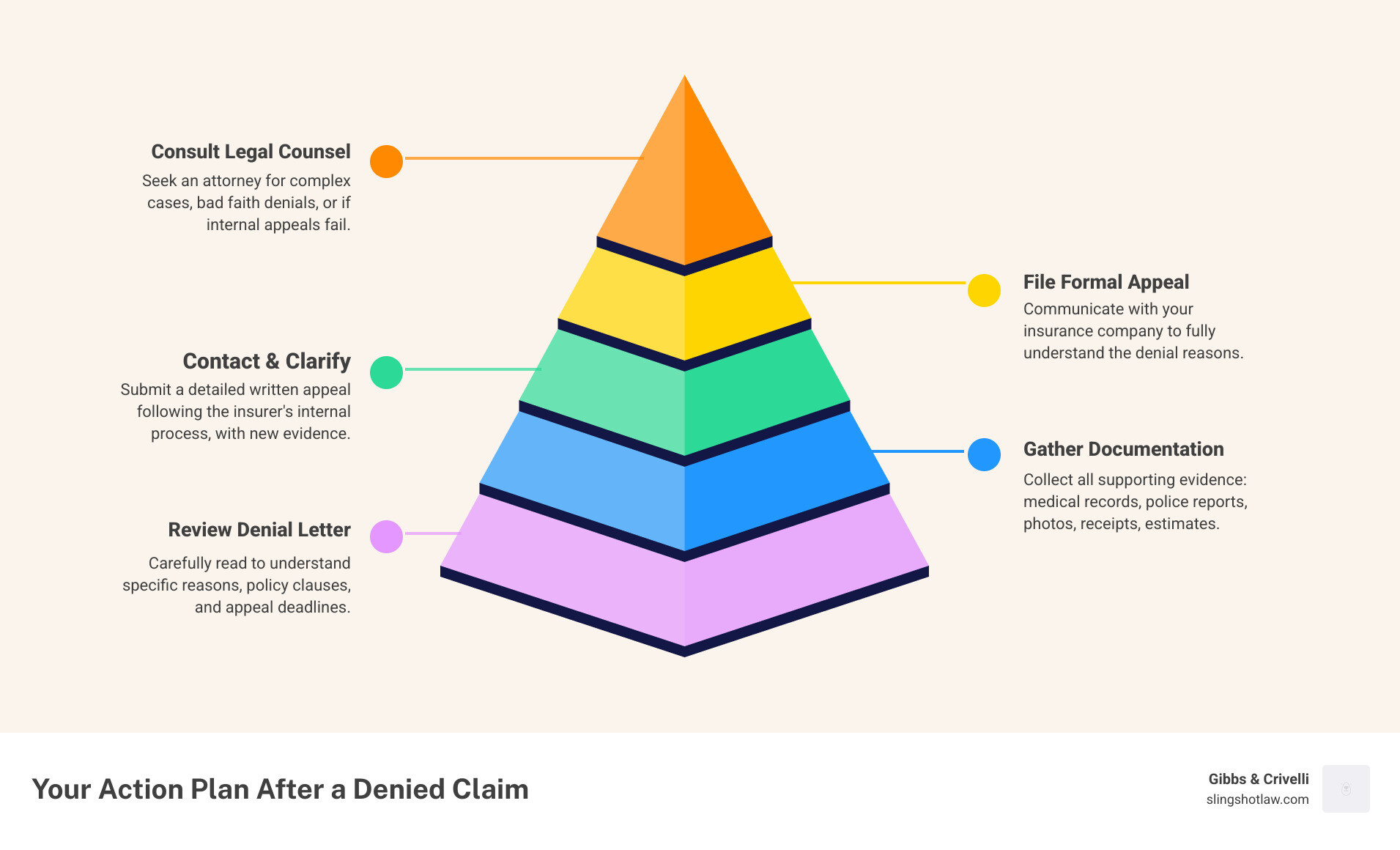

If your insurance claim was denied, here’s what you need to do immediately:

- Read your denial letter carefully – Understand the specific reason given

- Gather all your documentation – Medical records, police reports, photos, receipts

- Contact your insurance company – Ask for clarification on the denial reason

- File a formal appeal – Follow their internal appeals process

- Consider legal help – Especially for complex cases or bad faith denials

You are not powerless. Whether you’re in Austin, Cedar Park, Round Rock, or anywhere in Central Texas, you have rights and options to fight an unfair denial.

Texas insurance companies deny claims for many reasons—some legitimate, others questionable. They might cite policy exclusions, claim you missed a deadline, or argue you failed to disclose something. While sometimes they’re right, they often hope you’ll simply give up.

The good news is that most denials can be successfully challenged. The key is to act fast and follow the right steps.

Why Insurance Companies in Texas Deny Claims

Insurance companies are not charities. While most claims are paid, a significant number face an insurance claim denial. After years of fighting for families across Austin, Cedar Park, and Round Rock, we’ve seen insurers look for any excuse to avoid paying, especially on large claims.

It saves them money. Their adjusters and lawyers are tasked with finding reasons to deny claims. Understanding their playbook is your first step in fighting back.

Common Reasons for an Insurance Claim Denial

Your denial letter will state a reason, but it’s often buried in confusing legal language. Here are the most common reasons for insurance claim denials we see in Texas:

Material misrepresentation is a major reason, especially for life insurance. If you forgot to mention a health condition or were inaccurate about your medical history, the insurer may claim they would have never issued the policy or would have charged more.

Missing premium payments is an obvious but common issue. If your policy lapses due to missed payments, any incident during that gap isn’t covered. We’ve seen this impact families in Georgetown and Temple who thought they were protected.

Policy exclusions are common. A standard homeowner’s policy doesn’t cover floods, and your auto policy might exclude rideshare use without commercial coverage. These exclusions are in the fine print but are legally binding.

Insufficient documentation is a frequent problem. Insurers require proof for everything: police reports, medical records, photos, and estimates. Missing or incomplete paperwork can be grounds for denial.

Missed deadlines can void a valid claim. Policies require you to report incidents and file claims within specific time frames. Missing these deadlines can lead to a denial.

Disputed liability is common in car accidents on Austin’s busy highways. If the insurer decides you were mostly at fault, they may deny your claim or reduce the payout.

Many of these reasons are not black and white. There’s often room to challenge the insurer’s interpretation, where experienced legal help is crucial.

Understanding Policy Loopholes and Exclusions

Insurance policies are complex legal documents, filled with technical language and exclusions designed to limit payouts.

Coverage limits can be a shock. If your policy covers $50,000 in property damage but you cause $100,000, you’re responsible for the difference. It’s not a denial, but it feels like one.

Excluded events are situations your policy won’t cover. Homeowner’s policies often exclude floods, earthquakes, and poor maintenance. Auto policies exclude intentional damage or accidents while breaking the law.

Policy language is tricky. Seemingly straightforward words can have specific legal meanings in insurance contracts, affecting what is actually covered.

For car insurance denials, general resources like What to Do When Your Car Insurance Claim Is Denied can help. However, every Texas policy is unique, and the specifics of your case are what matter.

The Two-Year Contestability Period for Life Insurance

Life insurance has a rule that often surprises families: the two-year contestability period. If the insured person dies within two years of the policy’s start date, the insurer can investigate the original application for any errors or omissions.

This is a thorough investigation. They will order medical records and check for accuracy. If they find undisclosed health conditions, medications, or risky activities, they can deny the entire claim.

We’ve seen this happen to Round Rock families where an honest mistake on an application led to a denial of a six-figure claim when the person passed away within the two-year window.

The suicide clause is also part of this period. Most policies won’t pay if the insured commits suicide within the first two years.

After two years, the insurer’s ability to deny a claim based on application issues is limited. They must prove outright fraud, which is much more difficult.

Being completely honest on your life insurance application is crucial, even if it means higher premiums. The risk of a denied claim isn’t worth the short-term savings.

Your Step-by-Step Action Plan After an Insurance Claim Denial

An insurance claim denial is disheartening, but it’s not the end. We’ve helped many clients in Killeen, San Marcos, and across Texas turn denials into payouts. Here’s our step-by-step guide.

Step 1: Carefully Review Your Denial Letter

This is your most important first step. The denial letter is a legal document outlining the insurer’s reasons. Read it carefully and look for:

- The Specific Reason for Denial: The letter must state why your claim was denied. Is it a policy exclusion, a missed deadline, or alleged misrepresentation?

- Citing Specific Policy Clauses: Insurers will refer to specific sections or exclusions in your policy. Find these clauses in your policy document and read them. Do you agree with their interpretation?

- Deadlines for Appeal: The letter will include your right to appeal and the deadline. These deadlines are strict, and missing them can forfeit your right to challenge the denial.

- Contact Information for the Adjuster or Appeals Department: Note who to contact for questions or to start an appeal.

If the reason is unclear, contact the insurer for a detailed explanation. Document the call: who you spoke to, the date, and what was said.

Step 2: Gather All Relevant Documentation and Evidence

To challenge a denial, you need a strong case backed by facts. Compile all documentation and evidence related to your claim. For our clients in Austin, Cedar Park, and Round Rock, we stress gathering local records:

- Police Reports: For accidents or criminal activity, get the official report from the Austin PD, Round Rock PD, or other local law enforcement. It contains crucial details, witness info, and fault determinations.

- Medical Records: For injury or life insurance claims, get all medical records: doctor’s notes, hospital records, test results, treatment plans, and bills from your Texas providers. These prove the extent of injuries or cause of death.

- Photos and Videos: Visual evidence is powerful. Photos or videos of the accident scene, property damage, or injuries can show the extent of damage and hazardous conditions.

- Receipts and Repair Estimates: For property damage, keep all receipts for repairs, temporary housing, and related costs. Get detailed repair estimates from qualified professionals.

- Witness Statements: If there were witnesses, gather their contact information and, if possible, written statements.

- Communication Records: Log all communications with the insurer: dates, times, names, and conversation summaries. Save all emails, letters, and other correspondence.

Comprehensive, organized documentation strengthens your position. Incomplete paperwork is a common reason for insurance claim denial, so don’t give them that excuse.

Step 3: File a Formal Appeal with the Insurance Company

After reviewing the denial and gathering documents, formally appeal the decision. Follow the insurer’s internal appeals process, which should be in your denial letter.

- Write a Clear and Concise Appeal Letter: Write a clear appeal letter stating your intent to appeal. Include your policy and claim numbers and the denial date. Explain why the denial was incorrect, referencing your policy and evidence. Be factual, not emotional.

- Reference Policy Language: Use the policy clauses from your review to argue your case. If an exclusion was cited, explain why it doesn’t apply based on the facts and policy wording.

- Submit New Evidence: Attach all documentation gathered. If the denial was for “insufficient documentation,” provide everything needed. Send copies, not originals, and keep a set for your records.

- Follow the Insurer’s Internal Process: Follow the insurer’s process, whether it’s a form or online portal. Send your appeal via certified mail (with return receipt) or a portal that confirms submission to create a paper trail.

- Stay Persistent: The appeals process takes time. Follow up politely but firmly if you don’t hear back within their stated timeframe, and document every attempt.

The goal is to persuade the insurer to reconsider. Many denials are overturned at this stage, especially those based on incomplete information or errors.

When and How a Lawyer Can Fight Your Denial

Sometimes, even after following our guide, the insurer upholds its insurance claim denial. They might be digging in on a technicality, or the stakes are too high to handle alone—a catastrophic injury in Austin, a major property loss in Cedar Park, or a large life insurance payout.

This is when you need to level the playing field. At Gibbs & Crivelli, we fight insurance companies across Texas, from Round Rock to Temple. We know their playbook from daily courtroom and negotiation experience.

Bringing a lawyer into your insurance claim denial changes the conversation. The adjuster is no longer dealing with a policyholder who might give up; they’re facing legal professionals who know Texas insurance law.

Identifying Insurance Bad Faith in Texas

Not every insurance claim denial is a simple disagreement. Some are insurance bad faith. Under Texas law, insurers have a legal duty to treat policyholders fairly and act in good faith.

When they fail, they can be held liable for damages beyond your original claim.

Unreasonable delays are a common form of bad faith in our Austin-area practice. An insurer taking months to investigate a simple claim may hope you’ll get desperate and accept a lowball offer or give up.

Failure to investigate properly is another red flag. We’ve seen insurers deny claims without interviewing witnesses or reviewing evidence. For one Round Rock client, a denial was based on a five-minute phone call, with no scene visit.

Misrepresenting policy terms is surprisingly common. Adjusters may deliberately misinterpret complex policy language to avoid paying, counting on you not knowing your policy well enough to object.

Lowball settlement offers are insultingly small offers that don’t cover your damages. Insurers know that financial desperation makes people vulnerable to accepting inadequate settlements.

The Texas Insurance Code protects against these tactics, but you need to know how to use it.

How an Attorney Challenges an Insurance Claim Denial

When we take your denied claim, our approach is methodical and aggressive. We start with a comprehensive legal analysis of your policy, denial letter, documentation, and the insurer’s handling of the claim.

We look for weaknesses, inconsistencies, and evidence of bad faith. We often find issues that are clear violations of Texas insurance law.

Next, we take over all communication with the insurer. This shifts the dynamic, as they now face lawyers who know what to ask and demand.

If negotiations fail, we are prepared to file a lawsuit. This isn’t a threat; we have extensive trial experience and will take your case to a jury if necessary.

During the findy process, we compel the insurer to turn over internal documents, emails, and claims manuals. We also depose company representatives under oath to explain their decision-making.

For complex cases, we use expert witnesses to support your claim. This includes medical professionals, accident reconstructionists, and financial experts to explain injuries, determine fault, and calculate damages.

Our experience with cases like truck accident claims gives us insight into insurer operations, which we use to build the strongest case for our Central Texas clients.

Potential Outcomes: From Settlement to Court Verdict

Fighting a denial with legal help can lead to far better outcomes than you could achieve alone.

An overturned denial is a common result. When we present a compelling legal argument with solid evidence, insurers often realize their denial won’t hold up in court. They may reverse their decision and pay the claim, sometimes with interest.

Negotiated settlements often happen during mediation. These can include your original claim amount plus compensation for hardship and stress from the wrongful denial. We’ve secured large settlements for clients in Georgetown and Killeen.

Court-awarded damages can be substantial. Texas juries often send a strong message to insurers who treat their neighbors unfairly.

In cases of bad faith, courts can award punitive damages. These are meant to punish the insurer and deter future misconduct. These awards can be significant, sometimes millions, for outrageous behavior.

The key is having experienced advocates who know Texas insurance law and aren’t intimidated by large insurers. That’s what we provide for families across Austin, Cedar Park, Round Rock, and Central Texas.

Frequently Asked Questions about Denied Claims in Texas

An insurance claim denial brings overwhelming questions. After years of helping families in Austin, Cedar Park, and Round Rock, we know what concerns you. Here are answers to common questions from our Central Texas neighbors.

How long do I have to file a lawsuit for a denied claim in Texas?

Time is critical when challenging a denial. Texas has strict deadlines, and missing them can permanently bar your case.

For personal injury claims, you generally have two years from the injury date to file a lawsuit. For example, a Georgetown car accident victim has two years to take legal action.

Contract claims, which include most insurance disputes, have a four-year statute of limitations in Texas. The catch? Your policy likely has a much shorter deadline.

Many policies legally require lawsuits to be filed within just one year of a denial. Insurers count on policyholders not knowing this and missing the deadline.

Don’t let them win. The moment you get a significant insurance claim denial, call us. We’ll review your policy’s deadlines to protect your rights.

What if my claim was denied for a pre-existing condition?

This is frustrating because it feels like you’re being punished for your health history, or accused of dishonesty. These denials are common in life and disability claims. The insurer may claim you failed to disclose information or that the condition isn’t new.

We fight these by examining the medical evidence. Was there a material non-disclosure, or was it a miscommunication or an unclear application question?

Is there a causal link between the pre-existing condition and the claim? Insurers often blame pre-existing conditions even with a weak connection. We work with medical experts to establish the true cause.

For life insurance, remember the contestability period. If more than two years have passed since the policy started, it’s much harder for the insurer to deny a claim based on pre-existing conditions.

We’ve successfully challenged these denials for clients in Round Rock, Temple, and our service area. The key is understanding both the medical and legal aspects.

Can I handle the appeal process myself without a lawyer?

You can handle a denial appeal yourself, and sometimes it works. But whether you should depends on several factors.

For simple denials, like a missing document or clerical error, a phone call or resubmission might resolve it.

But complex denials involving policy exclusions or questions of credibility are different. This is legal territory where experience matters.

The value of your claim is also crucial. For claims worth thousands, the stakes are too high. A mistake could cost you more than our fees.

Our biggest worry is missing deadlines. Without legal guidance, it’s easy to miss a deadline or file incorrectly, which can be irreversible.

Working with us gives you expert knowledge of Texas insurance law, advocates who speak the insurer’s language, and a team focused on maximizing your compensation.

We offer free consultations to residents in Austin, Cedar Park, Killeen, and our other service areas. Let us review your denial and explain your options. We often spot issues and opportunities you might miss.

Get the Compensation You Deserve

Facing an insurance claim denial feels like David versus Goliath. The insurer has teams of lawyers protecting their bottom line. You don’t have to face them alone.

At Gibbs & Crivelli, our mission is to level the playing field for Central Texas families. Whether you’re in Austin, Cedar Park, or Round Rock facing a denial, we understand.

We know how insurance companies think because we fight them every day. We’ve seen their delay tactics and attempts to wear you down. We became lawyers to stand up for people treated unfairly by large corporations.

Our clients in Pflugerville, San Marcos, Killeen, Temple, Harker Heights, and Georgetown trust us because we deliver results. We’ve overturned countless denials, secured millions in settlements, and held insurers accountable for bad faith.

Here’s what makes us different: We work on a contingency-fee basis. Our “no-win, no-fee” promise is real. You pay nothing unless we win your case. This means we’re personally invested in your success because we only get paid when you do.

Call us for a free case evaluation. You’ll get a caring team with the courtroom experience to back up our promises. We’ll review your insurance claim denial, explain your rights, and map out a strategy to fight for the compensation you deserve.

Don’t let an unfair denial be a permanent defeat. Contact an Austin injury lawyer for your denied claim and let us show you what experienced fighters can do.

Your insurer made a promise. It’s time to make them keep it.